Global IT Spend Expected to grow 8% in 2024

Panther Equity Insights -- a private equity newsletter covering all things IT, Tech, Business Services, eCommerce and Markets.

Happy Tuesday folks! Welcome back to this week's edition of Panther Equity Insights, the bi-weekly newsletter from Panther Equity Group.

This week we’re looking at:

IT Spending Growth

Industry Commentary on Software M&A, MSPs, and Macro

Private market insights on Tech Sector Expectations

Our aim is to provide you with the latest insights and advancements in these verticals, along with valuable perspectives. We strive to create a newsletter that is informative and thought-provoking for all market participants.

We’re Looking For Deals 🎯

Our team is focused on making investments within the IT Services, Technology Services, Business Services & eCommerce verticals. Along with our operating partners, we have decades of experience paired with a vast network of experienced executives and LP investors.

Size: EBITDA of $2 million – $12 million

Geography: U.S. or Canada headquarters

Target Transaction: Majority, significant minority, and structured equity investments

Business Profile: Founder or closely-held ownership with an experienced management team

Additionally, Panther is actively looking for ‘add-on’ investments that meet the following criteria:

Industry: IT Digital Transformation / Software Dev 💻

Size: Up to $7 million in EBITDA

Geography: Flexible

Target Transaction: Majority recapitalization

If you’re a Founder / Shareholder interested in working with Panther, or an intermediary with a deal to share — feel free to reach out and get in touch with us! We are happy to compensate fees to intermediaries & referrals at market levels.

Broader Market Chatter

Global IT Spend to grow 8% in 2024

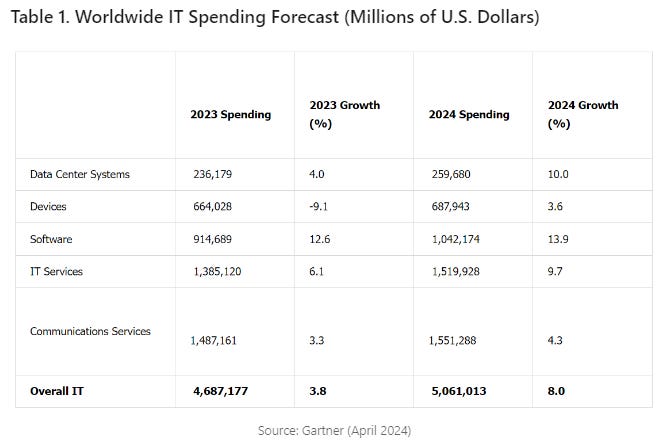

In 2024, Gartner forecasts global IT spending is forecasted to reach $5.06 trillion, an 8% increase from 2023, in their latest report. This far surpasses earlier predictions and suggests IT spending will exceed $8 trillion by the end of this decade.

Services still remain most significant in terms of size and growth, with IT services expected to grow by 9.7% in 2024. The IT services market will surpass $1.52 trillion market size, on its way to replace communications services as the largest segment of overall IT.

Gartner notes a shift towards reliance on IT service firms over internal staff, driving increased investment in consulting. This stems from enterprises lagging behind IT service firms in their ability to attract talent with essential IT skill sets, causing a growing necessity to allocate more resources towards consulting expenditure rather than internal staffing.

2024 marks a pivotal point in the trend of shifting towards services, as more capital is now being directed towards consulting services than internal staff for the first time. This trend is expected to continue as IT services continue to grow faster than the broader market.

Investment in data center systems is also on the rise, with a projected 10% growth in 2024, primarily due to preparations for generative AI adoption. Enterprises are progressing from planning to execution in GenAI integration, with providers already implementing these capabilities into their offerings.

This surge in GenAI adoption has also led to increased investment in infrastructure supporting large-scale projects, such as servers and semiconductors. AI infrastructure will be crucial in shaping IT spending trends over the near-term.

About Us

Panther Equity Group is a private equity firm focused on making investments within the IT Services, Technology Services, Business Services & eCommerce verticals.

Our team and Operating Partners have decades of experience within our focus verticals along with a vast network of experienced operators and LP investors.

We have the Operational, Technology, M&A, Business Development, and industry-expertise to help companies accelerate and reach their full potential. Learn more about Panther Equity Group by heading over to our website:

A Trusted Partner For Founders, Companies & Entrepreneurs

Industry Commentary

Macro & Inflation

🎤 Are inflation fears overblown? The outlook for inflation, US growth, and long-term rates

Cybersecurity MSP

📖 Secure, Out-of-Band Comms Offer MSPs Opportunity

Software M&A

🎤 When the Dam Breaks on Tech Deals with Thoma Bravo’s Holden Spaht

If you’re a company Founder / Shareholder interested in working with Panther, a deal maker interested in connecting or with a deal to share, or an Operating Executive looking for a part-time, full-time, or a Board Level Role — feel free to get in touch with us!

Private Market Movements

Tech Sector Continues Attracting Capital amid High Expectations

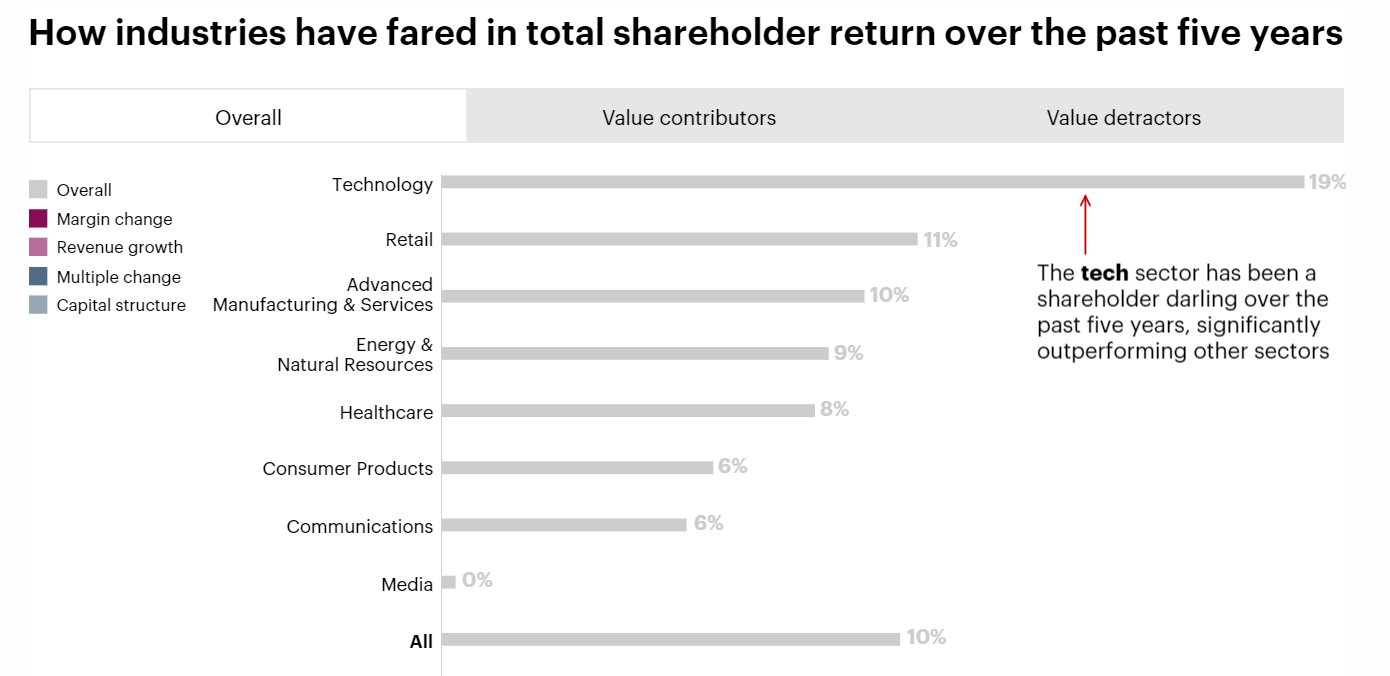

The tech sector has remained the spotlight of private and public capital investment in the last five years, and future expectations remain elevated. According to Bain’s latest study, technology has achieved 19% annual returns on average from 2019-2024

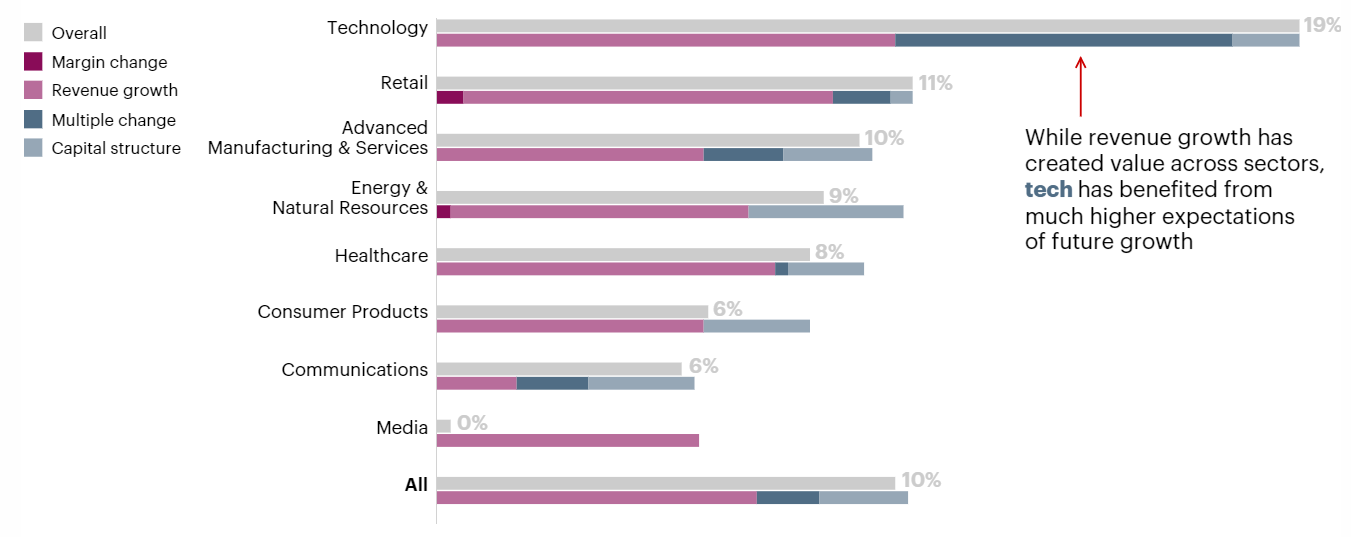

Strong historical performance, as well as promising digitalization tailwinds, are the main factors why tech has continued to attract capital in a tight market. Confidence about future growth has increased returns for the technology industry, whereas general pessimism has decreased value in other industries.

As seen in the chart below, technology has outperformed the broader market by roughly 900 basis points, or 9%.

What factors are driving this strong figure? Most of it is derived from high revenue growth due to strengthening digital trends increasing various tech market sizes, including IT as discussed. However, much of the returns are also from increased valuation multiples. Investors have high expectations of future growth in the tech sector and are willing to pay premiums to capture it through investments today.

Overall, tech is expected to benefit from increased investment and confidence over the near-term, but that capital has strings attached. Tech investment must meet the high expectations investors are setting today, or risk sharp value corrections.

Today, it appears tech is set to meet investors expectations due to the strong digital tailwinds, but operators and investors alike must monitor the tech sector’s profitability and investor sentiment carefully to stay ahead of possible swings

About Panther Equity Group

Panther Equity Group is a private equity sponsor seeking to provide capital, strategic support, and resources to healthy & well-positioned private companies in the lower middle market. We typically focus on companies with $2 million - $12 million in EBITDA and seek to make majority or significant minority equity investments.