Bytes & Buyouts: Tech & B2B Services Continue to Drive Activity

Panther Equity Insights -- a private equity newsletter covering all things IT & Telecom, Tech & Business Services, eCommerce and Markets.

Welcome to another edition of Panther Equity Insights! Whether you are a business owner, current or potential investor, or operate within the IT & Telecom Services, Technology Services, Business Services, or eCommerce sectors, we are delighted to have you with us.

This week we’re looking at:

Why Panther and other LMM PE firms remain excited about founder run companies

Drivers for the increase in IT and Business Services spending despite the macroeconomic backdrop

Industry commentary from fellow operators and investors

Our aim is to provide you with valuable insights, reports, firm updates, and thought leadership on the latest trends and advancements in these verticals. We strive to create a newsletter that is easy to read, thought-provoking, and entertaining.

We’re Looking For Deals 🎯

Our team is focused on making investments within the IT & Telecom Services, Technology Services, Business Services & eCommerce verticals. Along with our operating partners, we have decades of experience within the mentioned verticals paired with a vast network of experienced operators and LP investors.

If you’re a Founder / Shareholder interested in working with Panther, or an intermediary with a deal to share — feel free to reach out and get in touch with us! We are happy to compensate fees to intermediaries & referrals at market levels.

Private Market Movements

Founder-Owned Businesses Are Becoming Strong Targets for LMM Private Equity Groups

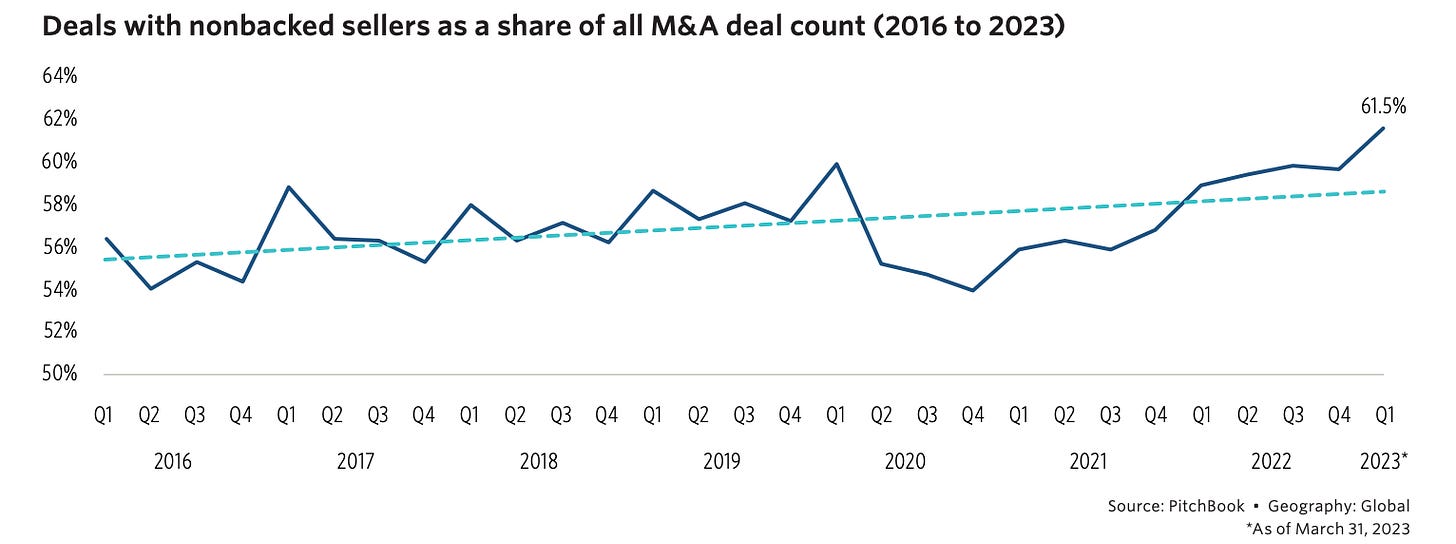

Private businesses owned by founders have increasingly become the primary source for mergers and acquisitions (M&A), experiencing a steady rise over the past seven years, with a notable surge in the last two.

In the first quarter of 2023, M&A deals involving founder-owned companies as targets represented 61.5%, an increase from 53.8% in the last quarter of 2020.

A recent Pitchbook report noted that the two main factors that have caused this rise include:

A shrinking supply of other seller types

With so many potential sellers on the sidelines or lining up to buy, who is selling? The answer, almost by process of elimination, is the nonbacked, private business owner.

Intense add-on activity by PE-backed platform companies

Market headwinds have caused acquirers to move down market given financing troubles with lager deal sizes.

While interest rates remain elevated, sponsors and corporate buyers are likely to continue investing in smaller, nonbacked companies on an add-on or bolt-on basis as long as they are conducive to earnings growth and financing for large platform or strategic acquisitions remains scarce.

Why is their a struggle to find sellers?

For the most part the exit market has dried up due to the dislocation in valuation expectations between buyers and sellers. Sellers are still expecting valuations based off of a post-covid market environment, meanwhile given the macroeconomic headwinds, rising rates and numerous other factors, buyers are unable to underwrite such expectations.

This is especially the case in sponsor-backed portfolio companies, as firms would rather hold assets until better liquidity options returns. Sponsor-backed M&A exits, declined in value by 39.9% and in deal count by 20.1% in 2022- and continue to fall throughout this year.

How does Panther think through this?

Panther is prioritizing relationships and deals whereby founders / partial sellers look to continue maintaining equity in their companies post transaction. Not only does this strengthen alignment between Panther and the founder, but can help bridge value differences where sellers (in the right situation) can continue receiving value + equity appreciation on the “2nd bite” during the investment period and subsequent re-exit.

As a reminder — Panther Equity Group has ample capital + LP relationships excited to make investments in 2023. If you are a company shareholder, deal intermediary, or advisor with a company that could be interested in a transaction (minority recapitalization, majority exit, or growth equity) in 2023, feel free to reach out!

Here’s an overview of our investment criteria ⬇️

Our Preferred Investment Criteria 🎯

Industry focus: IT & Telecom, Business Services, and eCommerce

Size: EBITDA of $2 million – $12 million / $10M to $100M enterprise value

Geography: U.S. or Canada headquarters

Target Transaction: Majority, significant minority, and structured equity investments

Business Profile: Founder or closely-held ownership with an experienced management team

Industry Commentary

Telecom Accenture’s recent insights report explains how 5G technologies can be used in private wireless networks to provide next level connectivity.

Digital Transformation The S&P Global podcast dives into how businesses are maximizing the customer digital experience while balancing the issues of data management, privacy, and security.

Middle Market M&A PitchBook’s Q2 2023 research finds founder-owned businesses have become attractive in the M&A landscape.

MSPs: Ingram Micro CDO, Sanjib Sahoo

Chart of the Week

Flexera’s recent survey of over 500 companies shows how organizations are planning changes to their use of external IT resources in 2023. As seen in the chart, the top five areas expected to see external spending growth are cybersecurity, big data / analytics, cloud operations, AI / machine learning, and automation. These are rapidly growing areas where the need for specialized skill sets makes external support more feasible than in-house up-skilling.

Broader Market Chatter

2023 IT and Business Services Trends

Global IT and business services spend is expected to increase 5.7% to $1.2 trillion in 2023 based on IDC’s latest forecast. All regions are expected to increase IT and business services spending in 2023 despite the macroeconomic backdrop.

Gartner VP John-David Lovelock explains, “We have an increase in the amount of services that CIOs need, because they're unable to grow and, in some cases, maintain their own internal staff. So, while they have more work to do, critical IT shortages across the world are playing against CIOs' need to hire.”

For the next five years, company staffing costs are expected to rise 2-4% per annum while IT services will expand 7-9% per annum, indicating CIOs will continue relying more on services for the medium-term. Within the forecasted services market growth, IDC expects outperformance from the U.S. market and business services.

U.S. IT and Business Services Spend Expected to be Strongest of Developed Markets

The U.S. services market grew 6.2% in 2022, outperforming previous forecasts by nearly 120 basis points. IDC notes the U.S. software market’s fundamentals and hardware installed base remain strong and forecast U.S. service growth to be 5.8%, 5.7%, and 5.2% over the next three years.

Though this still represents easing growth, the slowdowns are much milder than previously forecasted. US buyers will need to balance efforts to reduce costs and manage risks while still meeting new digital customer expectations and having access to consulting talent anywhere. Spending optimization will ultimately be outweighed by the urgent need to continue digital transformation initiatives.

Business Services Forecast Adjusted Upwards Despite Shorter Contracts

Most executives are bringing in more consultants as they believe digital initiatives are taking too long to complete. However, CIOs are still uncertain about the future and are signing shorter contracts as a result. A typical two or three-year contract has transformed into multiple, pricier eight month-contracts.

Because of higher pricing, as well as lower attrition rates and strong digitization demand, IDC has adjusted their forecast for the business services sector’s long-term growth rate to 7% instead of 5.5%. The strong growth of 6.7% in 2022 also suggests that slowdowns in 2023 and 2024 will be less significant than expected.

How does Panther think through this?

We are excited for these trends to continue and areas we are leaning into. Panther is actively working with companies in the B2B Services & IT Services end-market and seeing strong 2023 performance by these companies with rapid organic growth, attractive profitability levels and areas we can add value in post transaction.

Panther Equity Insights <> Deal Bridge Media

This newsletter was powered by the team at Deal Bridge Media. Deal Bridge builds newsletters for M&A firms to help them generate more inbound deal flow.

Does your investment firm want to start a newsletter? Get in touch with Deal Bridge today!

About Panther Equity Group

Panther Equity Group is a private equity sponsor seeking to provide capital, strategic support, and resources to healthy & well-positioned private companies in the lower middle market. We typically focus on companies with $2 million - $12 million in EBITDA and seek to make majority or significant minority equity investments.